Battery Energy Storage Systems (BESS)

OUR GOAL

Battery energy storage systems play a key role in fulfilling the recent commitments made by nearly 200 countries at COP28 to put the global energy system on a path to net-zero emissions by 2030. With the ever-increasing integration of renewable energy sources into the energy landscape, energy storage systems play a pivotal role, offering sustainable and cost-effective solutions for stabilizing the power grid. With our partner, enerpeak GmbH, we are developing BESS projects for grid stabilization. In addition, we are cooperating with our wind farm partners to develop projects that enable the supply of large-scale consumers such as data centers through 24/7 CFP PPAs.

OUR PROJECTS

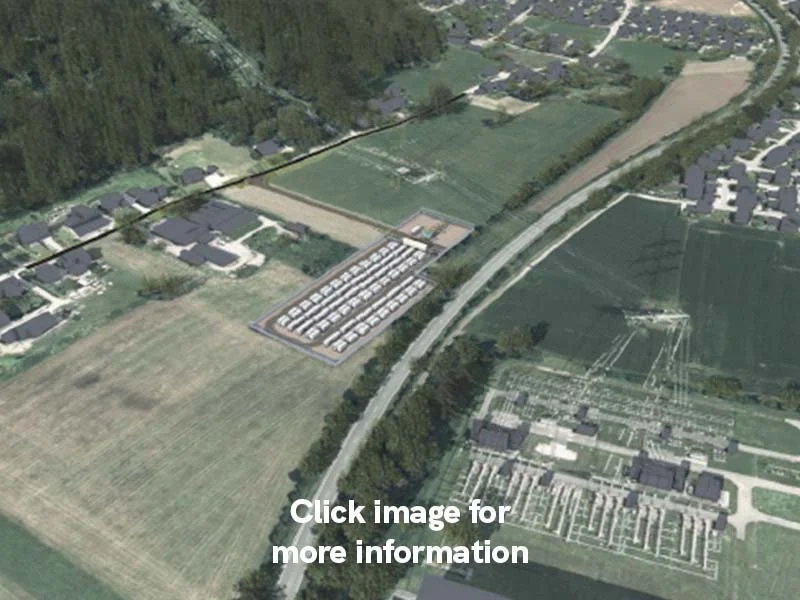

TRIVERRA Group's partner enerpeak GmbH develops grid-scale (Front of the meter) BESS projects across Germany at all grid levels with capacities from 100 MW to 350 MW. Moreover, enerpeak's work focuses on the development of co-location projects, for example, with wind farm partners, to optimally combine the efficiency of green energy sources and BESS. The company's in-house expertise in the energy market and power grids, as well as its engineering knowledge, in collaboration with leading battery storage system component manufacturers such as CATL, TGOOD, CRRC, and Sungrow enables the implementation of tailor-made configurations for optimal project efficiency and longevity.

TURN-KEY FOR INVESTORS

Germany is the largest electricity market in Europe and therefore offers considerable potential for the expansion of energy storage infrastructure. In addition, the expansion of renewable energies in Germany is progressing rapidly. The fast expansion of BESS projects makes them a new asset class in the infrastructure sector, offering investors exceptional opportunities. TRIVERRA Group develops its BESS projects turnkey for investors. Depending on the investor's objectives, various BESS Revenue Strategies for electricity trading are available. This allows individual projects or portfolios to be tailored precisely to the investor's profile.

Project Overview

Projects

Active:

Pipeline:

10

20

Capacity

1.5 GW

3.5 GW

Substations

3

7

BESS Units

300

900

Ready to Build

2026

2027 - 2028

Example BESS Projects

BESS Revenue Strategies

Various revenue strategies, each with its own risk and return profile, are available for BESS projects. These revenue strategies determine the bankability and economic feasibility of a BESS use case and range from high-risk, high-reward fully merchant setups to variable floor pricing arrangements to reliable tolling agreements and hybrid setups.

FULLY MERCHANT

A fully merchant setup exposes a project to the full downside and the full upside potential. If BESS performs well commercially, this model captures the highest returns, but it features no protection against loss if the asset’s performance is affected by unfavorable market conditions. The high-risk profile of the fully merchant strategy is reflected in the client’s proportionally higher revenue share. Trader, who operate BESS in a fully merchant setup, receive a profit share of ~10%-15 %.

FLOOR

A floor price is the minimum revenue an asset owner makes when using the optimization service of an RTM (route-to-market) provider. This amount is typically contractually fixed. The guaranteed revenue is lower than in a tolling agreement because the asset owner maintains the upside potential, while the optimizer assumes the main risk. The guaranteed minimum revenue can increase depending on the asset’s trading outcome and the contractually fixed revenue split.

HYBRID

If optimization parameters allow, a hybrid model can be applied as a revenue strategy. In a hybrid setup, the battery capacity is segmented and individually contracted. For example, a 10 MW battery can have half its capacity tolled and the other half fully merchant (with or without floor, with or without cap). The intention of this division is diversification. It caters to asset owners interested in merging varying risk and revenue profiles.

TOLLING

The tolling revenue strategy is an agreement between an asset owner (toller) and an RTM (route-to-market) provider that combines revenue stability with risk mitigation. Tolling agreements for BESS grant the asset owner a pre-defined sum of guaranteed revenue, independent of the commercial result achieved by the RTM provider who, in exchange, has the right to utilize the asset’s capacity in the markets as desired and put limitations on the toller.

BESS Key Facts

BESS CONFIGURATION

BESS plants are individually designed in size, battery technology, use case and voltage level, but essentially they all have the same modular structure. Battery modules grouped into racks are placed into 6-foot containers with auxiliary systems forming a BESS-Container and an inverter with transformer forming a step-up transformer skid container. As an example, 20 BESS container and 10 step-up transformer skid container would have a capacity of 50 MW / 100 MWh.

BATTERY LIFE AND REPOWERING

Most BESS systems last between 10 and 15 years, though some can operate for up to 20 years. A battery's life is often expressed in cycles and is heavily influenced by its chemistry and operational patterns, by way of example depth of discharge (DOD) and C-rate. Repowering can extend the life of a BESS to 30 years or more and is a way to improve the asset's performance and revenue potential. In most cases, repowering involves replacing individual battery packs.

COMPLIANCE AND CIRCULAR ECONOMY

TRIVERRA Group and its partner enerpeak are committing our suppliers to adhere to the EU regulations and the German Supply Chain Due Diligence Act (LkSG) including Life Cycle and Sustainability Assessments. Moreover, all projects will follow a new upcoming EU regulatory frameworks for ecodesign and batteries, that requires from 2027 a Digital Product Passport (DPP) for each battery. This is to collect and share product-related data to foster circular business models.

OFFSETTING UNAVOIDABLE EMISSIONS

While BESS projects are an important tool for achieving the energy transition, the production, development, and operation of BESS projects still generate unavoidable embedded and operational emissions. To offset the negative climate impacts of our BESS projects, TRIVERRA Group is developing its own Rainforest Conservation Project in Brazil. High-quality biodiversity certificates help ensure the goal of climate-neutral BESS projects throughout their entire life cycle.

Supply Chain Partners

TGOOD

Leading global manufacturer of T&D infrastructure, product range from MV to HV, including high-power transformers, Switchgear and substations. The company owns the world's largest EV charging network.

CATL

CATL is a battery manufacturer and technology company that specializes in the manufacturing of lithium-ion batteries for electric vehicles and energy storage systems, as well as battery management systems.

CRRC

World's largest manufacturer of traction and drive systems. Largest BESS integrator in China, 3rd IGBT/SiC manufacturer in the world by capacity, 6th largest wind turbine manufacturer in the world.

Sungrow

Sungrow has installed 740 GW of power electronic converters worldwide and is recognized as the world's No. 1 on PV inverter shipments and the most bankable Asian energy storage company.

Let’s Work Together

We’re always looking for new locations for BESS projects, primarily in German markets and across Europe and North America. In addition, we are comfortable working in joint ventures and are open to collaborate with new partners and investors, primarily in European and North American markets. Please get in touch, and we will reach out to you to discuss collaborations.